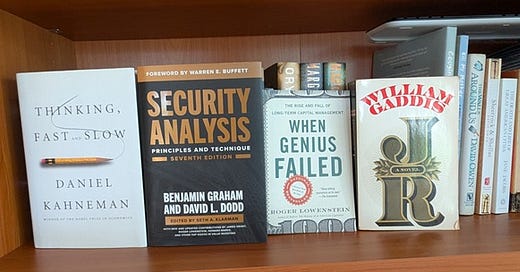

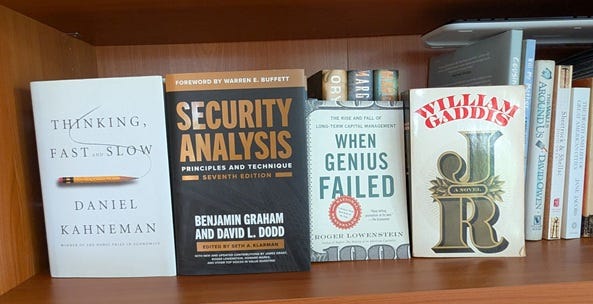

Four Good Finance Books but One is Not Like the Others

I should clarify that there is one easy way to get rich, be born into wealth (my old boss at NIH always said, “marry where there is money”).1 Unfortunately, this only applies to a select few and most of us have to work for a living and be prudent about our investments. American’s have had a preoccupation with wealth almost since the founding of the country. It continues today with the proliferation of television shows that center on wealthy individuals (remember ‘The Apprentice’?😁).

Get rich schemes have been around for a long time. The infamous Charles Ponzi is well known for running a scheme where first investors were paid by money coming in from subsequent investors until no new investors could be coaxed into providing funds and the pyramid of cards collapses. History repeated itself with the recent Madoff investment scandal which was also nothing more than a pyramid scheme. Though these pyramid schemes are illegal; companies that form multi-level marketing organizations are careful branding the company as ‘affiliate marketing’ or ‘home-based business franchising.’ The author and podcaster Jean Marie does a great job covering this in ‘Selling the Dream: The Billion-Dollar Industry Bankrupting Americans.’2 Over 90% of those who enroll in MLM companies not only lose their initial investment but end up owing money.

Gambling, whether it is casino games, sports betting, poker, lotteries, or almost any wager that you can conceive of is seldom a road to riches. Some gambling activities require a level of skill that most of us do not possess (poker, sports betting3 ). Casino games are always tilted in favor of the house and the odds of winning the Power Ball or MegaMillions lotteries are extremely small (Power Ball odds on winning the jackpot: 1 in 292,201,338). I will occasionally splurge for a $2 ticket, but only if the jackpot is over $500 million. It is fun to think about what you might do with the money, but that dream is dashed the next morning when you look up the winning numbers. Over the years, I’ve maybe purchased 60-70 tickets and NEVER even won a single prize (odds: 1 in 24.87).

Although my efforts at getting rich via the lottery route did not pan out, I did have two successes, one in sports betting and the second, at the blackjack table. As noted in an earlier Substack, I was a sportswriter and columnist in college. I was also an avid follower of both college and professional football. Santa Barbara was a small town in the 1960s and as far as I knew, other than the local marijuana trade, there was no organized crime in the town. There was, however, a small-time bookmaker who distributed football parlay cards every Tuesday.

A parlay card had a list of college football games for the upcoming weekend along with the point spread for the winning team. The line would look like this: ‘UCLA 25 Cal’. If you pick UCLA and they defeat Cal by more than 25 points (in those days Cal was a poor team), you win; if they only win by25 or fewer you lose. You can take the underdog and get the points (Cal can still lose but if they lose by less than 25 points, you win). The card would have about 20 games listed. You had to bet on a minimum of three games and could bet on all 20 if desired. The more games you picked the greater the payoff, but you had to have them all correct. I think the cards cost $2 though you could wager more. One week I was feeling very confident about 10 games (payout was 100 – 1) and handed over the card and $10. By 6 PM, eight of my picks were spot on. However, most of the teams in Texas and the Southeast played their games at night. The only way to get those scores (this being 1968) was to go to the school paper office and get the scores off the AP teletype. Of the two games I had pending, one came in, but eight-point favorite Tennessee (my pick) was thumped by Auburn, wiping me out. My major success was taking the New York Jets and the 17 points offered in bets on Super Bowl III. That was the last football game I bet on.

In 1970, I headed off to Indiana University for graduate school. I selected a route that would take me through the high plains into the Midwest, areas that I had never visited. My first stop was Las Vegas right before Labor Day weekend. I spent the summer reading ‘Beat the Dealer’ by UC Irvine math professor Ed Thorp. Thorp devised a blackjack card counting scheme that as the game goes on, predicts when the odds will shift from the house to the player. I spent hours with a deck of cards, until I felt comfortable in executing Thorp’s strategy. In those days, there were still a number of casinos using a single deck at the blackjack tables (this makes it much easier to execute a winning strategy). I walked across the street to The Frontier and took a seat at the $2 table. I had $50 to gamble with and three hours max to play (I had to drive to Salt Lake City the next day). If my winnings reached $500, I would walk away; they did, and I did. I was able to pay for the next seven days of the trip to Bloomington and still have money left over. I have not been in a casino since.

BOOKS ON FINANCE

In addition to four books in the picture, one great book that everyone should read is ‘Extraordinary Popular Delusions and the Madness of Crowds.’ Written almost two centuries ago by Charles Mackay, it has some great chapters on economic bubbles and manias. Although Mackay occasionally stretches the truth, the book offers a number of cautionary tales. What is even better is you can get it for free over at Project Guttenberg!!

Now in its seventh edition, Graham and Dodd’s ‘Security Analysis’ is updated under editorship of Seth Klarman and featuring chapter introductions to the original 1940 text from a variety of well-known investors. There are also some new chapters to adapt to changes in finance and investing that have evolved since the core textbook was published. Graham and Dodd’s writing can be dry at times but their approach to value investing has stood the test of time. Warren Buffett studied under both at Colombia University in 1950-51. If you don’t want to wade through 800 pages, Graham wrote a shorter book, ‘The Intelligent Investor’, that encapsulates his thinking on investing in common stocks. The third edition contains excellent commentary on Graham’s writings of 75 years ago by Jason Zweig.

It is worth pondering this snippet from the introduction to ‘The Intelligent Investor’:

Our text is directed to investors as distinguished from speculators…. There are no easy paths to riches on Wall Street or anywhere else.

You can speculate on cryptocurrency but need to realize the risk associated with that. Capital preservation is important and as Buffett put it in two rules: 1) never lose money and 2) don’t forget rule 1.

If you like this content, please click the subscribe button.

‘When Genius Failed’ by Roger Lowenstein, is a tale of hubris in thinking that you are the smartest person in the room and immune from failure. It is the story of Long-Term Capital Management, its rise and implosion. The company had the best and brightest of investment minds including two Noble Prizewinners in Economics. The firm took on way too much leverage and when markets turned volatile in 1998, the firm began to lose over $100 million per day until all the assets were gone within five weeks and had to be bailed out to avoid a worldwide panic. Lowenstein is a superb financial journalist, and the book reads just like a thriller even though you know the outcome.

Daniel Kahneman was a pioneering researcher in the field of cognitive psychology and decision-making. His work in behavioral economics was rewarded with a Nobel Prize in 2002. His 2011 book, ‘Thinking Fast and Slow’, is an excellent distillation of his research and points to the importance of two systems of how we think. The first is instinctual and emotional while the second is deliberative and logical. The important section for those interested in investing is the one on heuristics and biases. Too often we are overconfident and decision making suffers as a result. This book is key to both understanding and making more intelligent decisions. This is central to the theme of Barry Ritholtz’s recent book ‘How Not to Invest’, also a book I recommend.

I offer William Gaddis’s ‘J R’ as a cautionary tale. I came to the book shortly after it won the 1976 National Book Award for Fiction (Gaddis later won a second Award for ‘A Frolic of His Own’, a humorous send up of America’s legal system). 11-year-old J R Vansant becomes fascinated with finance while on a school field trip to Wall Street. From there, he builds a conglomerate of disparate companies using assets from one to buy another in an uproarious send up of the emerging private equity industry. That Gaddis was prescient in predicting how this would all end is amazing, and I did not see this at the time of my first reading. The added exposition of mid-1970s culture is a bonus. One needs patience to read J R. With the exception of some scarce narrative passages, it is all told in dialogue. Oh yes, the book is over 700 pages but once the reader gets into the rhythm Gaddis sketches out, it goes by quickly and you easily figure out who is talking and to whom. Both ‘Ulysses’ by James Joyce & ‘Gravity’s Rainbow’ by Thomas Pynchon are as long and I think much more difficult.

J R was not confined to just this novel. In 1987, Gaddis had a humorous piece in the New York Times where an older (and much wiser) J R testified before a Congressional Committee when he was working at the Office of Management and Budget. It’s a great commentary on ‘trickle down economics’, the Federal debt, and Defense Department procurement. Just change a couple of the numbers, the piece is just as relevant today.

A 19th century book not shown in the picture, but worth reading is Anthony Trollope’s ‘The Way We Live Now’, based on the financial scandals in 1870s London. It is a nice portrayal of English society as well. The book is available as a free download from Project Gutenberg. A recent work of fiction, and Pulitzer Prize winner, about finance is Hernan Diaz’s ‘Trust’. It is a fictional account of a secretive Wall Street financier of the early 20th century and how his fortune survived the depression. The structure of the book is modeled on Rashomon, being told from for different individual’s vantage points.

WARREN BUFFETT

Warren Buffet and Charlie Munger with See's Candy, a Berkshire-Hathaway Company

At the Berkshire-Hathaway annual meeting this year, Warren Buffett announced he would be stepping down as CEO at the end of this year.4 Buffett acquired textile company, Berkshire-Hathaway, in the 1960s for the investment fund he was running at the time. He ran the company with his vice-chair, Charlie Munger, until Munger passed away a couple of years ago. The company morphed into a conglomerate with acquisitions in insurance, energy, a large freight railroad, manufacturing and services/retail. Currently, the company has a large amount of funds in cash and short-term treasury bills (estimated to be $314 billion which is the fourth largest holder in the world)

You can get a lot of Buffett’s wisdom for free!! His yearly letters to shareholders from 1977 to present are available on the Berkshire-Hathaway website. Buffett has always been candid about his investment mistakes. He recognized early on the importance of insurance companies in the portfolio. Insurance companies collect cash up front and pay out claims at a later date. The money on hand called ‘the float’ and can be invested to earn returns. The other major part of Berkshire-Hathaway is the common stock holdings in companies such as American Express, Coca-Cola, Apple, Chevron, and a number of others. These companies all have well-known brands and generate significant cash flow that is paid out to Berkshire-Hathaway as dividends.

I doubt we will see an investor as successful as Buffett again.

Let me know if you have an investor or finance book that you like by

leaving a commentRECIPE

Shrimp Scampi

This recipe serves two but is easily scaled up. Figure on 1/3 pound of shrimp per person (6-7 depending on the size). Heat two Tbs olive oil over medium heat until hot and add 2/3 pound of shrimp. Sauté for 2 minutes turning the shrimp. Add 2 Tbs of butter and 2 garlic cloves (finely minced). Continue to sauté for another minute and then add ½ C of dry white wine along with ½ tsp Kosher salt and ground pepper. Cook for another minute or two while the sauce reduces by 1/3. Remove from the heat and finish the dish by adding the juice from 1 lemon, 1/8 tsp of Aleppo Chile Pepper, and 2 Tbs chopped Italian parsley (I find this more flavorful than regular parsley and since family members have an aversion to cilantro, this is what I regularly use). We like this served over fettuccine that has been cooked al dente and tossed with a bit of olive oil.

Nothing in this post should be construed as investment advice! That’s not my job, it is yours.

I am now providing Amazon links to books. I recommend that you purchase the books from a local independent bookstore. However, if you like to read on a Kindle or don’t have a bookstore nearby use Amazon. I do not derive any income from Amazon.

Nate Silver in his recent book, ‘On the Edge: The Art of Risking Everything,’ notes that over the course of a single NBA season he bet $1.8 million betting on games, for a grand profit of $5,242. Could you do better? I might have done OK had I bet against the Washington Wizards this past season. Most games they failed to cover the spread.

Disclosure time. I have been a Berkshire-Hathaway shareholder since 2008.